Use this table In case your mother or father or someone else can declare you as a dependent in 2024 and also you’re blind.

When your tax refund quantities are inadequate to pay That which you owe in your bank loan, you won't be needed to repay any remaining balance. Having said that, you may well be contacted to remind you on the remaining stability and provide payment Recommendations to you personally if you choose to repay that balance.

Having said that, tax deferral encourages U.S. firms to create work-creating investments offshore even though identical investments in The us is often extra lucrative, absent tax things to consider. Furthermore, corporations try and use accounting strategies to file income offshore by any way, even if they preserve precise financial investment and Work in the United States.

Expenses to file your federal return are prohibited: Corporations within the IRS Cost-free File Program gained’t demand you anything to file your federal tax return in the event you qualify.

usatoday.com wishes to ensure the greatest experience for all of our viewers, so we built our internet site to reap the benefits of the latest technological know-how, rendering it speedier and simpler to use.

To become a complete member of AICPA, the applicant have to hold a sound CPA certification or license from at the least one of many fifty-five U.S. point out/territory boards of accountancy; some added demands use.

These obligations are frequently not the tax from the Company, though the method may possibly impose penalties on the Company or its officers or personnel for failing to withhold and shell out in excess of these kinds of taxes.

Type 1040-ES is utilized by people with profits not topic to tax withholding to figure and pay out approximated tax.

PES has applied diligent initiatives to offer high-quality facts and content to its customers, but won't warrant or promise the precision, timeliness, completeness, or currency of the knowledge contained herein. In the end, the duty to comply with applicable authorized needs falls exclusively upon the individual licensee, not PES. PES encourages you to Get in touch with your point out Board for the most recent information and facts and to verify or make clear any concerns or worries you've got about your duties or obligations for a accredited Skilled.

We extended our Business hrs to assist you to file by April fifteen. Get rolling with your local Professional, on the other hand you desire.

Even though the CPA exam is uniform, licensing and certification demands are imposed independently by Every single point out's regulations and so differ from point out to point out. Some states Use a two-tier technique whereby somebody would first turn into Accredited—usually by passing the Uniform CPA Test. That personal would then later on be qualified to get certified the moment a specific degree of work expertise is accomplished. Other states Possess a one particular-tier procedure whereby somebody Accounting might be Accredited and certified at the same time when each the CPA Examination is handed and the work encounter necessity continues to be met.

The U.S. federal helpful corporate tax amount has grown to be A great deal reduce compared to the nominal rate because of tax shelters which include tax havens.

Instructional institutions and non-revenue organizations often qualify for these pros, which bolster their capacity to serve the community.

For more than ten years E-file.com has provided cost-effective tax planning program which is approximately fifty% inexpensive than what other online tax preparers charge.

Alisan Porter Then & Now!

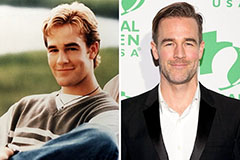

Alisan Porter Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!